Sharing your donation

29 October 2013

By Ian Robertson

Table by Michael Erez

From Vancouver Magazine Fall 2013

Why it’s better to donate securities than cash

Canada has long provided generous tax incentives for Canadians who donate to charitable organizations by means of a two- tiered tax credit. Since 2006, an additional incentive has allowed Canadians to donate publicly traded securities with unrealized gains – producing significant tax benefits for donating shares, instead of cash, to a registered charity.

The basics

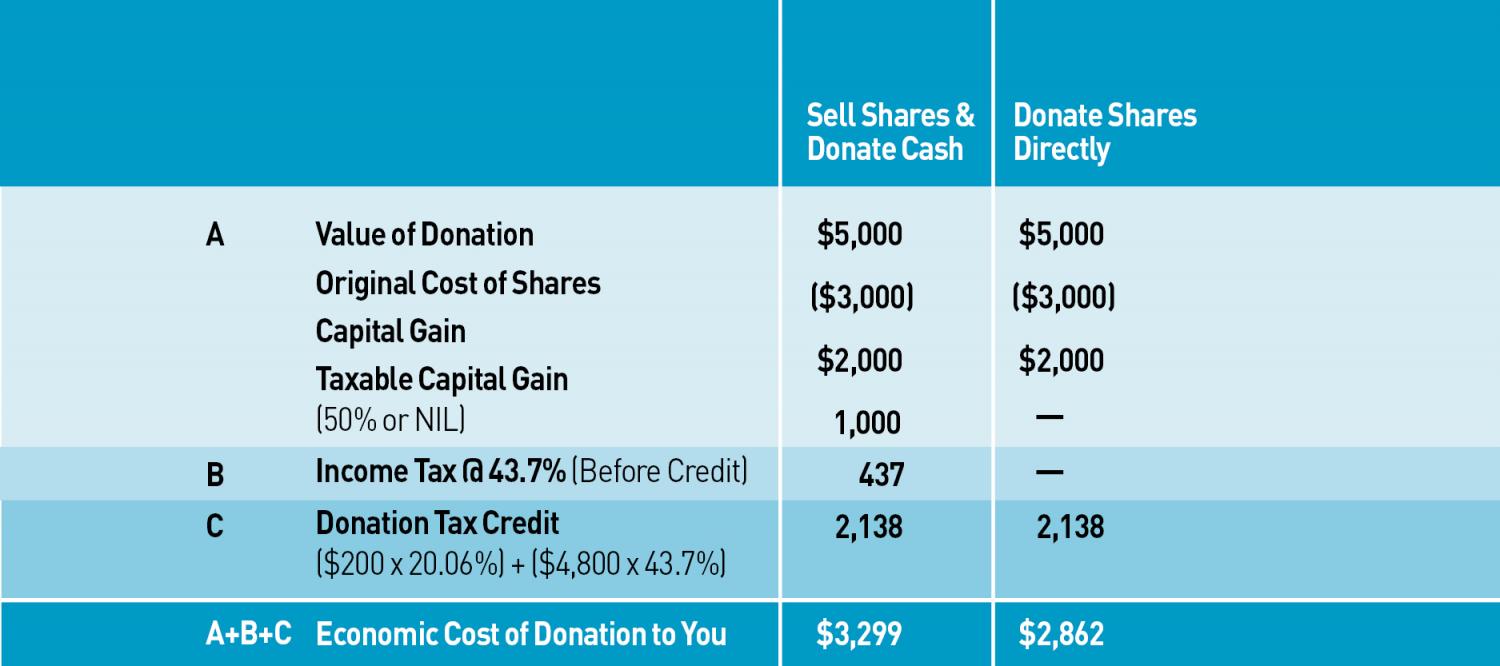

On the first $200 of charitable donations claimed in a year, a BC taxpayer receives a tax credit of 20 per cent, or $40. The credit on donations in excess of $200 is worth 43.7 per cent. For example, a $5,000 donation would result in a tax credit worth $2,138 [($200 x 20 per cent) + ($4,800 x 43.7 per cent)]. The maximum donation amount that can be claimed for a tax credit in a given year is 75 per cent of your net income, but any donations not claimed in the year they are made can be claimed in any of the following five years. The annual limit for donations that can be claimed in the year of your death or the year preceding your death is 100 per cent of your net income.

Publicly traded securities

In addition to the tax credit you’ll receive based on the current value of the shares or other securities donated, as of 2006, any capital gains on donations of publicly traded securities to a registered charity are not taxable. For example, suppose you purchased shares of XYZ Co. for $3,000, and they are now worth $5,000. If you sell the shares and donate the proceeds to charity, you can expect to pay $437 in capital gains taxes (assuming a marginal tax rate of 43.7 per cent).

However, since you would receive a tax credit of $2,138 on your $5,000 donation, the total cost to you would be $3,299 (see table). On the other hand, if you choose to donate the shares directly to a charity, you would not only receive a tax credit of $2,138, as stated above, but you would also save the $437 in capital gains taxes. In this scenario, the total cost of your $5,000 donation would be just $2,862 (see table).

To learn more about tax incentives for donations to registered charitable organizations, or for more information about the products and services offered by Odlum Brown Limited, contact Ian Robertson at Odlum Brown Limited at 604.844.5424.

The information contained in this article is for general information purposes only, and is not intended to provide financial, legal, accounting or tax advice. You should consult directly with your financial advisor before acting on any matter discussed. Source: October 2012 OB Report by Michael Erez, Financial andTax Planner with Odlum Brown Financial Services Limited, a subsidiary of Odlum Brown Limited.

Our 2013 Gift of Securities donation deadline is Tuesday, December 17, 2013 at 5pm.

For more information, please contact Peter Jackman, Development & Donor Services, at 604.629.5357 or at peter.jackman@vancouverfoundation.ca